Free Articles of Incorporation Template for South Dakota

Similar forms

Bylaws: Like the Articles of Incorporation, bylaws outline the rules and procedures for a corporation's internal management. They detail how decisions are made, the roles of officers, and meeting protocols.

Arizona Annual Report: This essential document is required for businesses in Arizona to update the Arizona Corporation Commission about their operations and ensure compliance. Completing this form is vital for maintaining accurate records, which can be facilitated through services like AZ Forms Online.

Operating Agreement: This document is similar for LLCs and outlines the management structure and operating procedures. It serves as a blueprint for how the business will function.

Partnership Agreement: This is akin to the Articles of Incorporation for partnerships. It defines the roles, responsibilities, and profit-sharing arrangements among partners.

Certificate of Formation: This document is often used interchangeably with Articles of Incorporation in some states. It serves to officially create a corporation and includes similar basic information.

Business License: While not a formation document, a business license is necessary for legal operation. It ensures that the business complies with local regulations, much like how Articles of Incorporation establish legal recognition.

Shareholder Agreement: This document is similar as it governs the relationship between shareholders. It outlines rights, responsibilities, and processes for buying or selling shares.

Annual Reports: These reports are required by many states after incorporation. They provide updated information about the corporation, similar to the initial details found in the Articles of Incorporation.

Registration Statement: For public companies, this document is similar as it registers securities for sale. It provides essential information to potential investors, akin to what Articles of Incorporation provide to the state.

Certificate of Good Standing: This document shows that a corporation is compliant with state regulations. It relates to the Articles of Incorporation by confirming that the corporation is active and recognized.

Nonprofit Articles of Incorporation: For nonprofit organizations, this document serves a similar purpose. It establishes the organization’s existence and outlines its purpose and structure.

Misconceptions

When it comes to filing the Articles of Incorporation in South Dakota, many people hold misconceptions that can lead to confusion. Here are seven common misunderstandings:

- All businesses must file Articles of Incorporation. Not every business needs to file this document. Only corporations, including nonprofit organizations, are required to submit Articles of Incorporation. Sole proprietorships and partnerships do not need this form.

- Filing Articles of Incorporation guarantees business success. While this form is essential for legal recognition, it does not ensure that the business will thrive. Success depends on various factors, including planning, marketing, and management.

- Anyone can file Articles of Incorporation without restrictions. There are specific requirements for who can file. Typically, at least one incorporator must be a person or entity that can legally conduct business in South Dakota.

- Once filed, Articles of Incorporation cannot be changed. This is not true. Amendments can be made to the Articles of Incorporation after they have been filed, allowing businesses to adapt as they grow.

- All information in the Articles of Incorporation is public. While certain details are public, some information, such as the names of the initial directors, may not be disclosed in all circumstances.

- There is no fee for filing Articles of Incorporation. A filing fee is required when submitting the Articles of Incorporation in South Dakota. The amount may vary depending on the type of corporation being formed.

- Filing Articles of Incorporation is the only step needed to start a business. This is a common misconception. Other steps, such as obtaining licenses, permits, and setting up a business bank account, are also crucial for operating legally.

Understanding these misconceptions can help you navigate the process of incorporating your business in South Dakota more effectively.

Fill out Some Other Templates for South Dakota

South Dakota Apartment Rental Application - A standardized form to ensure all necessary details are provided by tenants.

The Rental Application form serves as a vital tool for landlords aiming to evaluate prospective tenants effectively. By harnessing this form, property managers can gather crucial data that determines an individual's fit for tenancy. For further information, you can explore this necessary Rental Application guideline to aid in understanding its importance.

South Dakota Purchase Agreement - The purchase agreement is a vital step in closing the sale of a home.

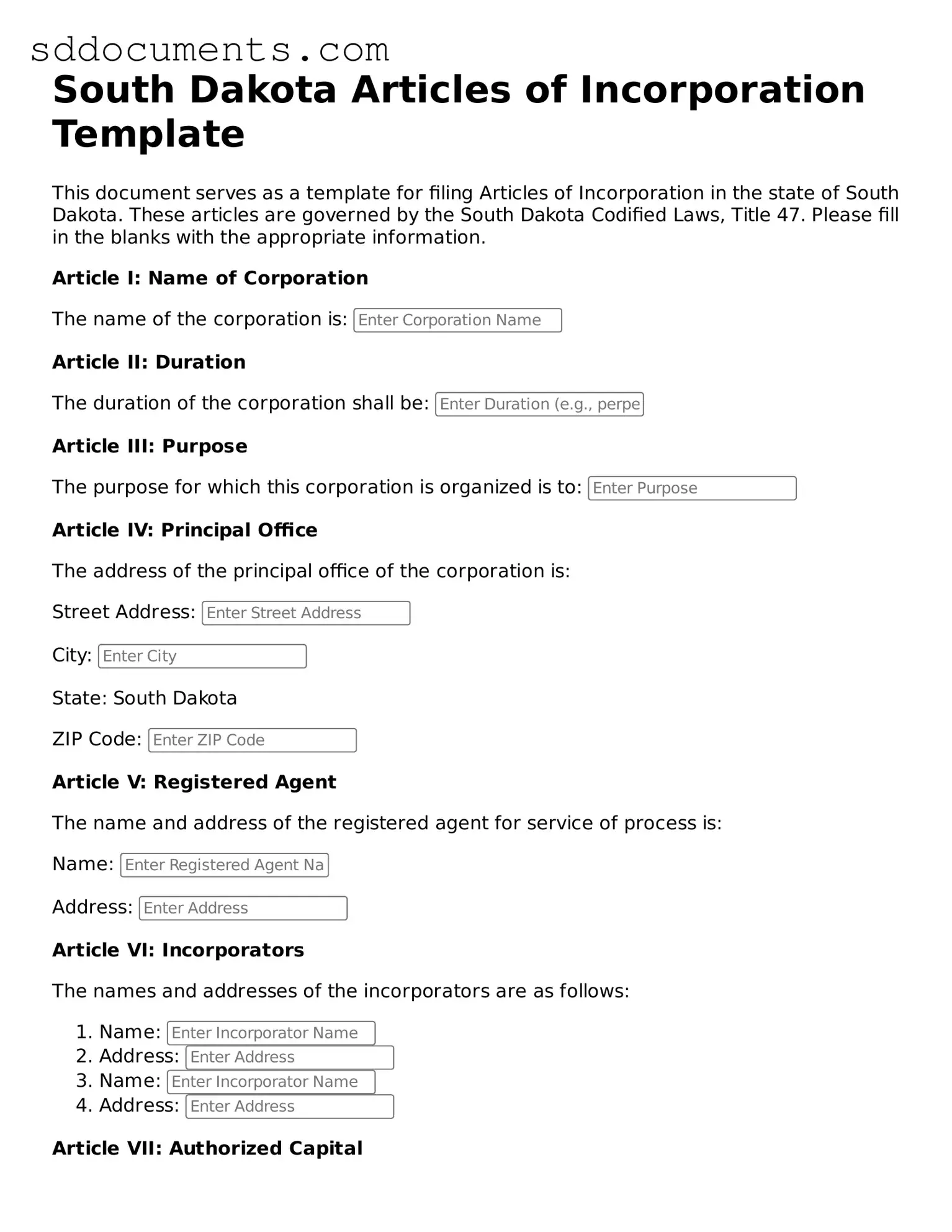

Guidelines on Utilizing South Dakota Articles of Incorporation

After completing the South Dakota Articles of Incorporation form, the next steps involve submitting the form to the appropriate state office and paying the required filing fee. Ensure that all information is accurate to avoid delays in processing your incorporation.

- Obtain the Articles of Incorporation form from the South Dakota Secretary of State's website or office.

- Fill in the name of the corporation. Ensure it complies with South Dakota naming requirements.

- Provide the address of the corporation's principal office. This should be a physical address, not a P.O. Box.

- List the name and address of the registered agent. This person or business will receive legal documents on behalf of the corporation.

- Specify the purpose of the corporation. A brief description of the business activities is sufficient.

- Indicate the number of shares the corporation is authorized to issue, if applicable.

- Include the names and addresses of the incorporators. These are the individuals responsible for setting up the corporation.

- Sign and date the form. All incorporators must sign.

- Prepare the filing fee. Check the current fee amount on the South Dakota Secretary of State's website.

- Submit the completed form and payment to the South Dakota Secretary of State's office, either by mail or in person.

Key takeaways

- Ensure that you have a clear understanding of your business purpose. This information is crucial as it defines the scope of your corporation's activities.

- Choose a unique name for your corporation. The name must comply with South Dakota naming requirements and should not be similar to existing businesses.

- Designate a registered agent. This individual or business entity will receive legal documents on behalf of your corporation. Make sure they have a physical address in South Dakota.

- Include the number of shares your corporation is authorized to issue. This will determine the ownership structure and can impact future fundraising efforts.

- Decide on the duration of your corporation. Most corporations are set up to exist indefinitely, but you can specify a limited duration if needed.

- File the Articles of Incorporation with the South Dakota Secretary of State. Ensure that you submit the correct filing fee along with your application.

- After filing, keep a copy of the Articles for your records. This document serves as proof of your corporation’s existence and is necessary for various legal and financial processes.