Free Deed Template for South Dakota

Similar forms

- Title Transfer Document: This document is used to officially transfer ownership of property from one party to another, similar to a Deed. Both serve to establish legal ownership and can be recorded with the county.

- Bill of Sale: A Bill of Sale is a document that transfers ownership of personal property. Like a Deed, it provides proof of the transaction and outlines the details of the sale.

- Lease Agreement: A Lease Agreement outlines the terms under which one party can use another party's property. While a Deed transfers ownership, a Lease Agreement grants temporary rights, but both are crucial in property management.

- Transfer-on-Death Deed: This deed allows property owners to designate beneficiaries who will receive their property upon death, providing a straightforward alternative to probate. This form can simplify estate planning significantly and ensures your wishes are clearly documented, similar to a Transfer-on-Death Deed that you may want to consider for effective property transfer.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. Both a Power of Attorney and a Deed can facilitate the transfer of property rights.

- Trust Agreement: A Trust Agreement establishes a trust to manage assets for beneficiaries. Similar to a Deed, it involves the transfer of property, but it does so for the purpose of managing assets over time.

- Quitclaim Deed: This is a specific type of Deed that transfers whatever interest the grantor has in the property, without guarantees. Like a standard Deed, it is used to convey property but with less assurance of ownership.

- Mortgage Document: A Mortgage Document secures a loan with property as collateral. While it does not transfer ownership, it is related to property rights and often accompanies a Deed in real estate transactions.

Misconceptions

When dealing with property transfers in South Dakota, there are several misconceptions about the deed form that can lead to confusion. Understanding these misconceptions can help ensure a smoother process when buying or selling property. Here are eight common misunderstandings:

- A deed must be notarized to be valid. While notarization is highly recommended, it is not strictly required for the deed to be valid in South Dakota. However, having a notarized deed can help prevent disputes in the future.

- All deeds are the same. There are different types of deeds, such as warranty deeds and quitclaim deeds, each serving a unique purpose. It's important to choose the right type of deed based on the specific circumstances of the property transfer.

- Once a deed is signed, it cannot be changed. While it is true that a signed deed is legally binding, it can be amended or revoked under certain conditions. This usually requires a formal process, so consulting with a legal professional is advisable.

- Only attorneys can prepare a deed. While attorneys can certainly assist in preparing a deed, it is not mandatory. Individuals can create their own deeds as long as they follow the legal requirements set forth by South Dakota law.

- A deed transfer automatically updates the property title. A deed transfer does not update the title automatically. It is essential to record the deed with the local county office to ensure that the new ownership is recognized legally.

- You cannot use a deed for property that has a mortgage. This is not true. A property with a mortgage can still be transferred through a deed. However, the mortgage lender may have specific requirements that need to be addressed during the transfer process.

- Deeds are only necessary for selling property. Deeds are not only used for sales; they can also be used for gifting property, transferring ownership between family members, or placing property in a trust.

- Once a deed is recorded, it cannot be contested. While recording a deed provides public notice of ownership, it does not prevent someone from contesting the deed in court. Disputes can arise for various reasons, including claims of fraud or lack of capacity.

By understanding these misconceptions, individuals can navigate the process of property transfer in South Dakota more effectively. Always consider seeking professional advice when dealing with legal documents to ensure compliance with local laws and regulations.

Fill out Some Other Templates for South Dakota

How to Get Out of a Lease in South Dakota - The notice must usually specify the reason for the tenant’s eviction.

When engaging in the sale or purchase of a vehicle in Illinois, it's important to utilize the Illinois Motor Vehicle Bill of Sale form to ensure a smooth transfer of ownership. This form not only serves as legal proof of the transaction but also aids in complying with state registration and taxation requirements. For convenience, you can find the form and additional information at https://vehiclebillofsaleform.com/illinois-motor-vehicle-bill-of-sale-template/.

Transfer on Death Deed South Dakota - Each beneficiary named in the Transfer-on-Death Deed will receive their share of the property automatically, simplifying inheritance.

Guidelines on Utilizing South Dakota Deed

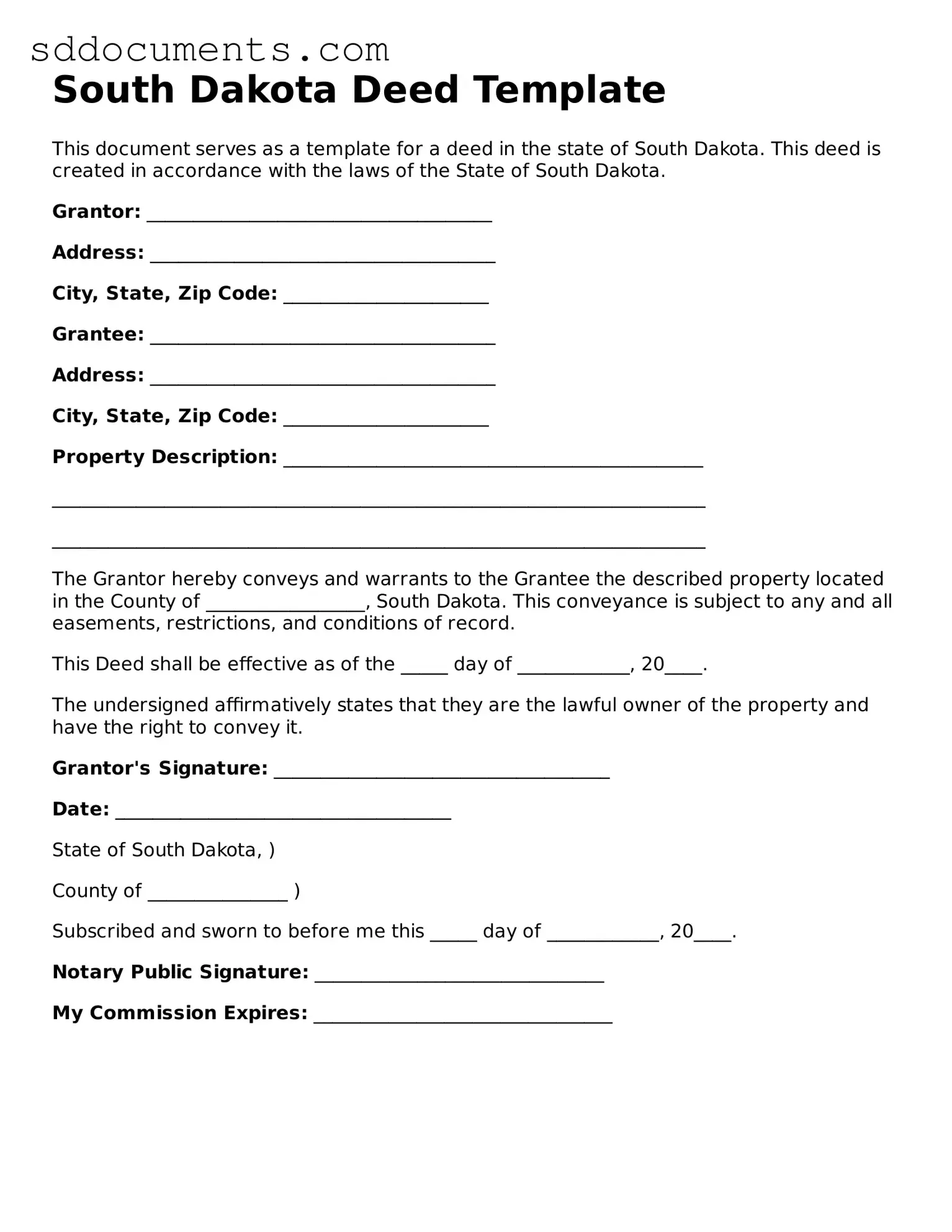

After obtaining the South Dakota Deed form, you will need to complete it accurately to ensure proper transfer of property. Follow these steps carefully to fill out the form correctly.

- Start by entering the date at the top of the form.

- Provide the name and address of the grantor (the person transferring the property).

- Next, fill in the name and address of the grantee (the person receiving the property).

- Clearly describe the property being transferred. Include details such as the legal description, parcel number, and address.

- Indicate the consideration amount, which is the price paid for the property.

- Sign the form in the designated area. The grantor must sign in the presence of a notary public.

- Have the notary public sign and stamp the form to validate it.

- Make copies of the completed deed for your records.

- File the original deed with the appropriate county office to complete the transfer.

Key takeaways

Filling out and using the South Dakota Deed form requires attention to detail and understanding of the process. Here are some key takeaways to consider:

- Understand the Types of Deeds: South Dakota recognizes various types of deeds, including warranty deeds and quitclaim deeds. Knowing the differences can help you choose the right one for your transaction.

- Gather Necessary Information: Before completing the deed, ensure you have all pertinent information, such as the names of the grantor (seller) and grantee (buyer), property description, and any existing liens.

- Accurate Property Description: A precise description of the property is crucial. This includes the legal description, which can often be found in previous deeds or property tax documents.

- Signatures and Notarization: All required parties must sign the deed. Additionally, a notary public must witness the signatures to ensure the document is legally binding.

- Filing the Deed: After the deed is signed and notarized, it must be filed with the appropriate county register of deeds. This step is essential for the deed to be legally recognized.

- Consult a Professional: If there are uncertainties or complexities in your situation, consider seeking advice from a real estate attorney or a qualified professional to ensure compliance with local laws.

By following these key points, you can navigate the process of filling out and using the South Dakota Deed form with greater confidence and clarity.