Free Durable Power of Attorney Template for South Dakota

Similar forms

- General Power of Attorney: Like the Durable Power of Attorney, this document allows someone to make decisions on your behalf. However, it typically becomes invalid if you become incapacitated, whereas the durable version remains effective in such situations.

- Health Care Proxy: This document designates someone to make medical decisions for you if you are unable to do so. Similar to a Durable Power of Attorney, it allows for decision-making authority but is specifically focused on health care matters.

- Transfer-on-Death Deed: This legal document facilitates the transfer of real estate to beneficiaries upon death without going through probate, ensuring property is passed on according to one's wishes. For more information, visit the Transfer-on-Death Deed page.

- Living Will: A Living Will outlines your wishes regarding medical treatment in end-of-life situations. While it doesn’t appoint someone to make decisions for you, it provides guidance to your agents, including those appointed by a Durable Power of Attorney.

- Financial Power of Attorney: This is a specific type of Power of Attorney that focuses solely on financial matters. Like the Durable Power of Attorney, it allows someone to handle your finances but may not necessarily remain valid if you become incapacitated.

- Revocable Living Trust: A Revocable Living Trust can manage your assets during your lifetime and distribute them after your death. While it serves a different purpose, it offers similar benefits in terms of asset management and can work alongside a Durable Power of Attorney.

- Springing Power of Attorney: This type of Power of Attorney only becomes effective under certain conditions, such as your incapacitation. While it shares similarities with the Durable Power of Attorney in terms of authority, it has a conditional aspect that the Durable version does not.

Misconceptions

Understanding the South Dakota Durable Power of Attorney (DPOA) form is essential for anyone considering this legal document. However, several misconceptions can lead to confusion. Here are ten common misconceptions about the South Dakota Durable Power of Attorney form, along with clarifications to help clear up any misunderstandings.

- A Durable Power of Attorney is only for the elderly. Many people believe that only older adults need a DPOA. In reality, anyone can benefit from having this document, regardless of age, especially if they want to ensure their financial and healthcare decisions are managed by someone they trust.

- A DPOA is the same as a regular Power of Attorney. While both documents allow someone to act on behalf of another, a DPOA remains effective even if the person becomes incapacitated. In contrast, a regular Power of Attorney becomes void if the principal loses mental capacity.

- Once a DPOA is signed, it cannot be changed. This is not true. The principal can revoke or amend the DPOA at any time, as long as they are mentally competent. It’s important to communicate any changes to the designated agent and any institutions involved.

- A DPOA can make medical decisions without restrictions. While a DPOA can grant authority for medical decisions, it is limited to what the principal specifies in the document. It’s crucial to outline the scope of medical decision-making powers clearly.

- Only lawyers can create a DPOA. Although it’s advisable to consult with a lawyer to ensure the document meets all legal requirements, individuals can create a DPOA on their own using templates, provided they follow state laws.

- A DPOA is only effective after a person becomes incapacitated. This is a common misunderstanding. A DPOA can be effective immediately upon signing, depending on how it is drafted. The principal has the option to specify when the powers begin.

- The agent must be a family member. While many people choose family members as their agents, it is not a requirement. Anyone the principal trusts can serve as an agent, including friends or professional fiduciaries.

- A DPOA gives the agent unlimited power. This is misleading. The authority granted to the agent is defined by the principal in the DPOA. It can be tailored to include specific powers or limitations.

- A DPOA is only for financial matters. Although it is often used for financial decisions, a DPOA can also cover healthcare decisions. The principal can specify what types of decisions the agent can make.

- Once the DPOA is in place, it is no longer necessary to communicate with the agent. Regular communication is vital. The principal should discuss their wishes and any changes in circumstances with the agent to ensure their preferences are understood and respected.

By addressing these misconceptions, individuals can better understand the importance and functionality of a Durable Power of Attorney in South Dakota. Having this document in place can provide peace of mind, knowing that trusted individuals can manage affairs in times of need.

Fill out Some Other Templates for South Dakota

Homeschool Homeschooling - Establishes the educational framework parents will use for their child's learning.

For those seeking accommodations, completing a thorough initial rental application process is crucial for showcasing candidacy to potential landlords. This step assists in gathering key data necessary for evaluating rental applications effectively.

South Dakota Poa - It helps healthcare providers by streamlining decision-making processes in urgent situations.

South Dakota Quit Claim Deed - A Quitclaim Deed is useful for transferring property to a business entity.

Guidelines on Utilizing South Dakota Durable Power of Attorney

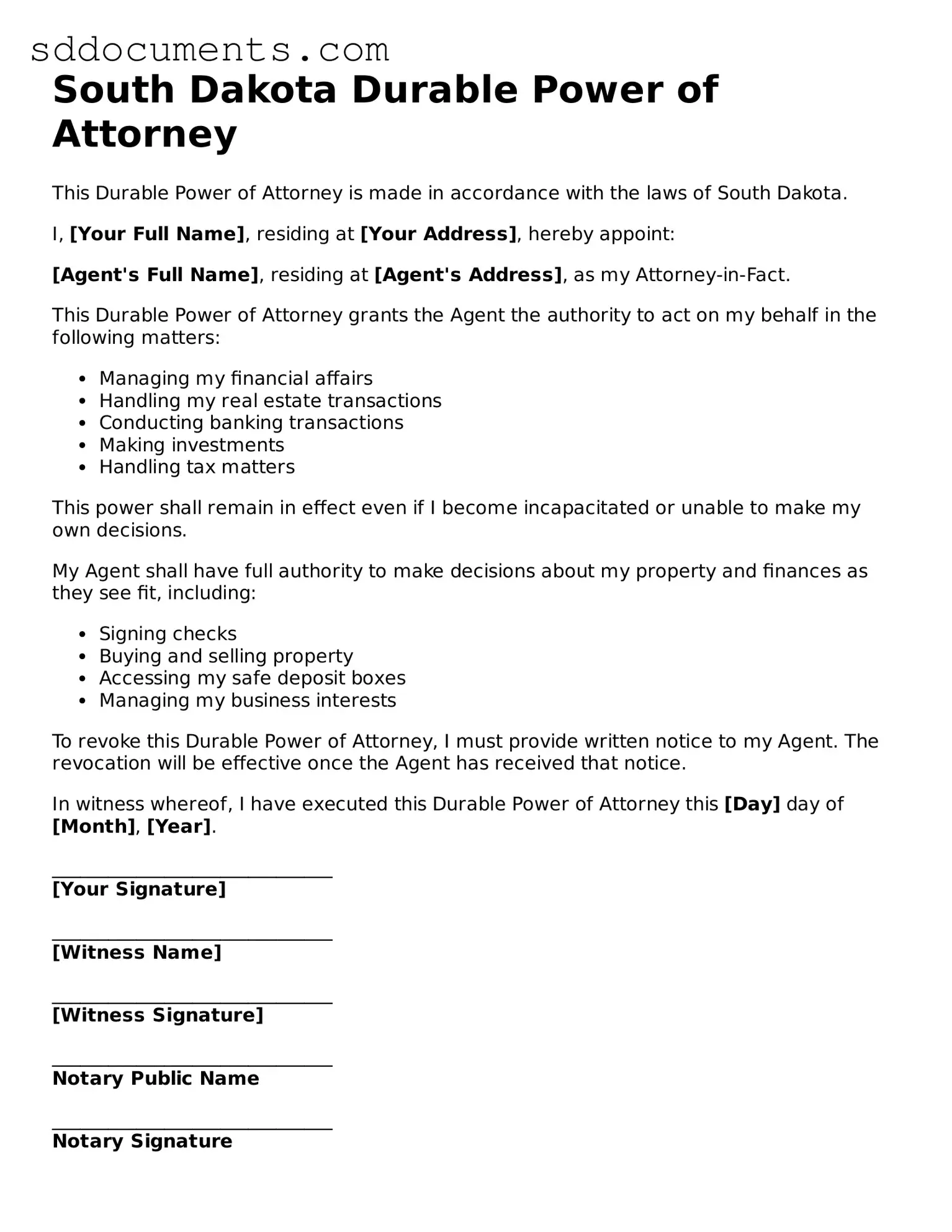

Filling out the South Dakota Durable Power of Attorney form requires careful attention to detail. Once completed, this document will enable you to designate someone to make decisions on your behalf in specific situations. Follow these steps to ensure that the form is filled out correctly.

- Obtain the South Dakota Durable Power of Attorney form. This can be found online or at legal offices.

- Read through the entire form to understand the sections that need to be completed.

- In the designated area, write your full legal name and address as the principal.

- Identify the agent by writing their full legal name and address. This person will act on your behalf.

- Specify the powers you wish to grant to your agent. This may include financial decisions, medical decisions, or both.

- Indicate the duration of the powers. You can choose to make the powers effective immediately or upon a certain event.

- Sign and date the form in the presence of a notary public. Ensure that the notary acknowledges your signature.

- Provide copies of the completed form to your agent and any relevant institutions or individuals.

Key takeaways

Filling out and using the South Dakota Durable Power of Attorney form is an important step in ensuring that your financial and medical decisions are managed according to your wishes. Here are five key takeaways to consider:

- Understand the Purpose: A Durable Power of Attorney allows you to designate someone to make decisions on your behalf if you become incapacitated.

- Choose Your Agent Wisely: Select a trusted individual who understands your values and can act in your best interest.

- Be Specific: Clearly outline the powers you wish to grant to your agent. This may include financial, legal, or healthcare decisions.

- Sign and Date the Document: Ensure that the form is signed and dated in the presence of a notary public to make it legally binding.

- Keep Copies Accessible: Provide copies of the signed document to your agent, healthcare providers, and any relevant financial institutions.

By following these guidelines, you can effectively use the South Dakota Durable Power of Attorney form to protect your interests and ensure your wishes are honored.