Free General Power of Attorney Template for South Dakota

Similar forms

- Durable Power of Attorney: This document allows someone to make decisions on your behalf, even if you become incapacitated. It remains effective until you revoke it or pass away, similar to a General Power of Attorney but with a focus on long-term use.

- Operating Agreement: To establish clear structures within your LLC, consider utilizing our foundational Operating Agreement form requirements to define member roles and responsibilities.

- Limited Power of Attorney: Unlike the General Power of Attorney, which grants broad authority, this document restricts the agent's powers to specific tasks or time periods. It’s useful for particular situations, such as handling a real estate transaction.

- Healthcare Power of Attorney: This form specifically allows someone to make medical decisions for you if you are unable to do so. While the General Power of Attorney covers financial and legal matters, this document focuses solely on health-related issues.

- Living Will: A Living Will outlines your wishes regarding medical treatment in situations where you cannot communicate. While it does not appoint an agent, it works in conjunction with a Healthcare Power of Attorney to ensure your preferences are honored.

- Revocation of Power of Attorney: This document serves to cancel any previously granted Power of Attorney. It is similar in that it involves the authority granted to another person but focuses on ending that authority rather than granting it.

Misconceptions

Understanding the South Dakota General Power of Attorney (POA) form is crucial for anyone considering this legal document. However, several misconceptions can lead to confusion. Here’s a list of common misunderstandings:

- It only applies to financial matters. Many people believe that a General Power of Attorney is limited to financial decisions. In reality, it can also cover health care decisions, property management, and more, depending on how it is drafted.

- It is permanent and cannot be revoked. Some assume that once a General POA is created, it remains in effect indefinitely. However, the principal can revoke it at any time, as long as they are mentally competent.

- Only lawyers can create a General POA. While it is advisable to consult a lawyer, individuals can create a General Power of Attorney on their own, provided they follow the state’s requirements for validity.

- It gives unlimited power to the agent. This misconception arises from a lack of understanding about the document. The powers granted can be specifically outlined and limited based on the principal’s wishes.

- Agents are required to act in the best interest of the principal. While agents have a fiduciary duty, some believe this means they cannot make decisions that benefit themselves. In reality, the agent can make decisions that may benefit them, as long as they do not violate their fiduciary responsibilities.

- It becomes effective immediately. Many think that a General POA takes effect as soon as it is signed. However, it can be set to become effective only under certain conditions, such as the principal’s incapacity.

- It is only necessary for elderly individuals. This misconception overlooks the fact that anyone, regardless of age, can benefit from having a General Power of Attorney in place, especially if they travel frequently or have specific health concerns.

- It is the same as a Living Will. A General POA and a Living Will serve different purposes. A Living Will outlines medical wishes, while a General POA grants someone the authority to make decisions on behalf of the principal.

- All states have the same rules regarding POA. Each state has its own laws governing Power of Attorney documents. South Dakota has specific requirements that may differ from those in other states.

- Once signed, it is too late to make changes. Many believe that after signing a General POA, they cannot make adjustments. In fact, as long as the principal is competent, they can modify or revoke the document at any time.

By addressing these misconceptions, individuals can make informed decisions about using a General Power of Attorney in South Dakota. Understanding the nuances of this important document is essential for effective planning and protection.

Fill out Some Other Templates for South Dakota

Transfer on Death Deed South Dakota - Secure your property for your loved ones by utilizing a Transfer-on-Death Deed for easy inheritance management.

The Indiana Transfer-on-Death Deed form is designed to simplify the process of passing on property to your beneficiaries, ensuring that it avoids the often complicated probate proceedings. By utilizing this deed, property owners can facilitate the direct transfer of real estate to their loved ones, providing peace of mind and clarity in estate planning. For more information, you can visit this page on the Transfer-on-Death Deed.

South Dakota Living Will - Your Living Will can serve as a guide for the medical team caring for you.

Guidelines on Utilizing South Dakota General Power of Attorney

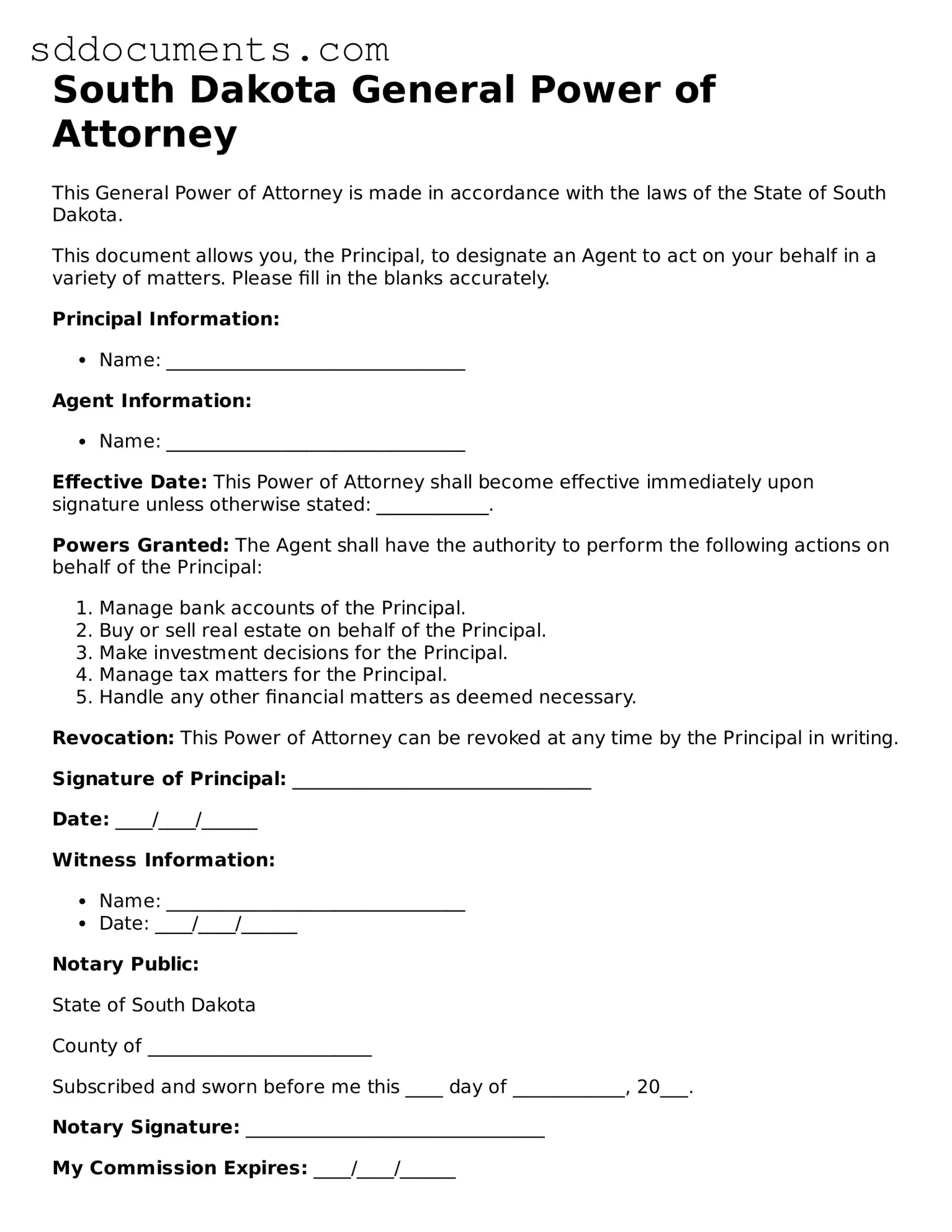

Filling out the South Dakota General Power of Attorney form is a straightforward process. This document allows you to appoint someone to make decisions on your behalf. It is important to ensure that the form is completed accurately to avoid any potential issues in the future.

- Obtain the South Dakota General Power of Attorney form. You can find it online or at legal stationery stores.

- Begin by filling in your name and address at the top of the form. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your agent. This person will act on your behalf.

- Specify the powers you wish to grant your agent. You can choose general powers or limit them to specific tasks.

- Indicate the duration of the power of attorney. Decide if it will be effective immediately or if it will start at a later date.

- Sign and date the form in the designated area. This confirms your intention to grant the powers outlined.

- Have the form notarized. A notary public will verify your identity and witness your signature.

- Provide copies of the completed form to your agent and any relevant institutions or individuals who may need it.

After completing the form, keep it in a safe place. Ensure that your agent understands their responsibilities and has access to the document when needed. Regularly review the powers granted to ensure they still align with your wishes.

Key takeaways

Filling out and using the South Dakota General Power of Attorney form is a crucial step in ensuring your financial and legal matters are handled according to your wishes. Here are key takeaways to consider:

- Designate a trusted individual as your agent. This person will act on your behalf in financial and legal matters.

- Clearly outline the powers you wish to grant. Specify whether the agent can make decisions regarding real estate, banking, or other financial matters.

- Ensure the form is signed in front of a notary public. This step adds validity and helps prevent potential disputes.

- Consider including a durable clause. This ensures the power of attorney remains effective even if you become incapacitated.

- Review the document regularly. Changes in your life or relationships may necessitate updates to the form.

- Keep copies of the signed form in a safe place. Provide a copy to your agent and any relevant institutions.

- Understand that your agent has a fiduciary duty. They must act in your best interest and manage your affairs responsibly.

- Be aware of any limitations. Certain powers may not be granted, depending on South Dakota law.

- Consult with a legal professional if you have questions. They can provide guidance tailored to your specific situation.