Free Promissory Note Template for South Dakota

Similar forms

- Loan Agreement: A loan agreement outlines the terms of borrowing money, similar to a promissory note. It specifies the amount borrowed, interest rates, and repayment schedule. Both documents serve to formalize a lender-borrower relationship.

- Tax Return Transcript: A Tax Return Transcript is essential for verifying income for various financial processes. It provides a summary of a taxpayer's return, including income and adjustments. If you're looking to obtain this document, access the Sample Tax Return Transcript form to get started.

- Mortgage: A mortgage is a specific type of loan secured by real property. Like a promissory note, it includes details about the loan amount and repayment terms. However, a mortgage also gives the lender a claim on the property if the borrower defaults.

- IOU (I Owe You): An IOU is a simple acknowledgment of a debt. While it lacks the formal structure of a promissory note, both documents indicate that one party owes money to another. An IOU is less detailed but serves a similar purpose in recognizing a financial obligation.

- Security Agreement: A security agreement is used when a borrower offers collateral for a loan. Like a promissory note, it outlines the terms of repayment. The key difference is that a security agreement includes specific details about the collateral involved.

Misconceptions

Understanding the South Dakota Promissory Note form can be challenging, especially with various misconceptions circulating about its use and requirements. Here are ten common misunderstandings:

- All promissory notes must be notarized. Many believe that notarization is a requirement for all promissory notes. In South Dakota, while notarization can enhance the note's validity, it is not strictly required for a promissory note to be enforceable.

- A promissory note must be in writing. Some think that verbal agreements are sufficient. However, for a promissory note to be legally binding and enforceable, it must be in writing.

- Promissory notes can only be used for loans. While they are commonly associated with loans, promissory notes can also be used for other transactions, such as payment for services or goods.

- Interest rates must be specified. There is a misconception that every promissory note must include an interest rate. In South Dakota, a note can be valid even if it does not specify an interest rate, though it may default to the state’s legal rate.

- All parties must sign the note for it to be valid. Some individuals believe that if one party does not sign, the note is invalid. In reality, only the borrower’s signature is essential for the note to be enforceable.

- Promissory notes are only for personal loans. Many assume these notes are limited to personal loans. In fact, they are widely used in business transactions as well.

- There is a specific format that must be followed. Some think that the South Dakota Promissory Note form must adhere to a rigid format. While certain elements are required, there is flexibility in how the note can be structured.

- Once signed, a promissory note cannot be changed. It is a common belief that a signed note is set in stone. However, parties can agree to modify the terms of the note, provided that any changes are documented and signed.

- All promissory notes are the same across states. Some people assume that the same rules apply in every state. Each state has its own laws governing promissory notes, so it is crucial to understand South Dakota’s specific regulations.

- Failure to pay means immediate legal action. Many believe that missing a payment automatically leads to legal consequences. In reality, lenders often provide a grace period or attempt to resolve the issue before pursuing legal action.

By clarifying these misconceptions, individuals can better navigate the use of promissory notes in South Dakota, ensuring they understand their rights and obligations.

Fill out Some Other Templates for South Dakota

South Dakota Poa - Effective immediately or upon a specific event occurring.

Filing the Arizona Annual Report form is not only a legal requirement, but it also serves as a valuable opportunity for businesses to reflect on their growth and progress over the past year. By submitting accurate and timely information, as detailed on AZ Forms Online, companies can demonstrate their commitment to compliance and operational integrity, fostering trust with stakeholders and clients alike.

South Dakota Small Estate Affidavit - Documentation of the deceased’s assets may be necessary for form completion.

Guidelines on Utilizing South Dakota Promissory Note

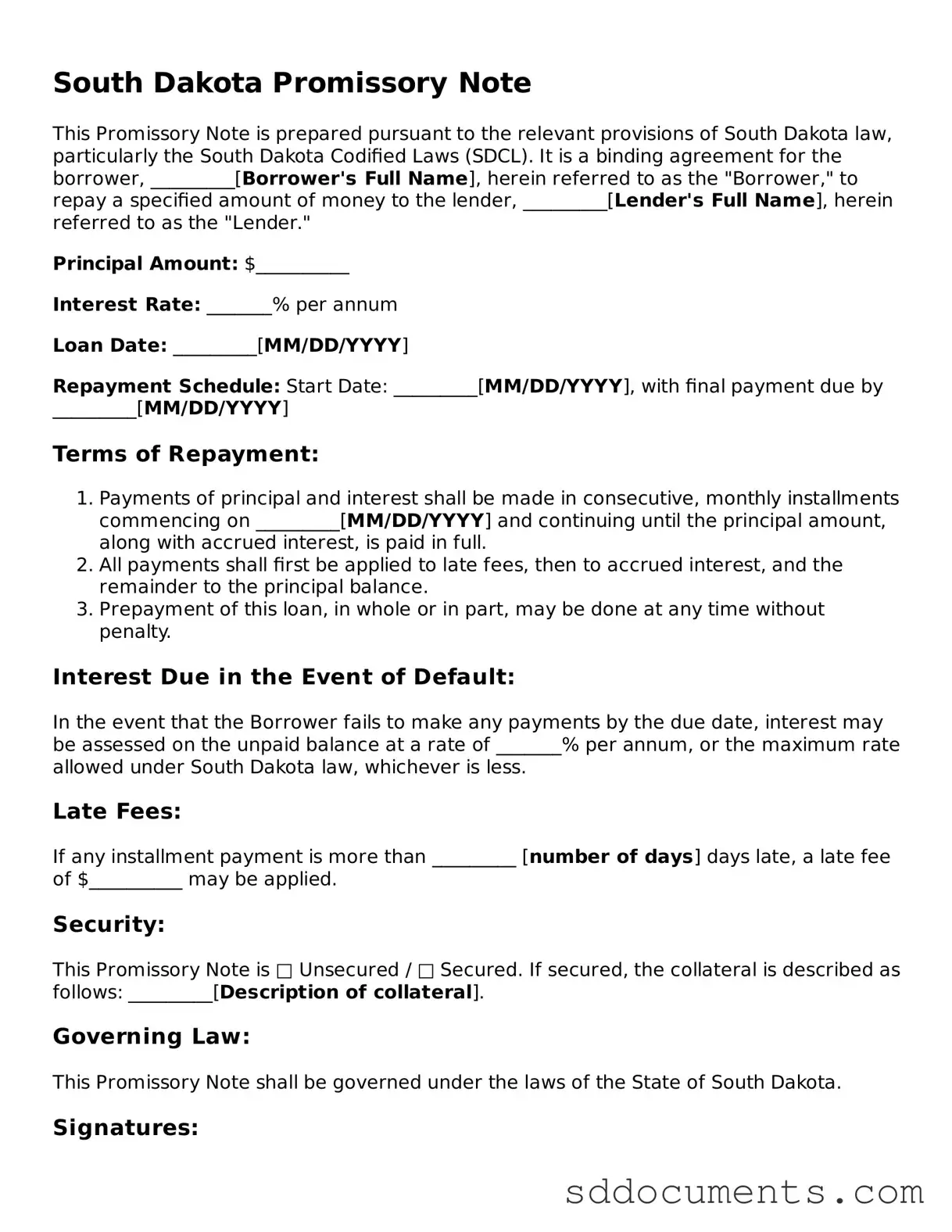

After obtaining the South Dakota Promissory Note form, you will need to carefully fill it out to ensure all necessary information is accurately provided. This document will require details about the loan agreement, including the parties involved, the amount borrowed, and repayment terms. Follow these steps to complete the form properly.

- Begin by entering the date at the top of the form.

- Clearly write the name and address of the borrower.

- Provide the name and address of the lender.

- Specify the principal amount being borrowed in both numbers and words.

- Outline the interest rate, if applicable, and whether it is fixed or variable.

- Detail the repayment schedule, including the frequency of payments (e.g., monthly, quarterly).

- Indicate the due date for the final payment.

- Include any late fees or penalties for missed payments.

- Sign and date the form at the bottom. If there are multiple borrowers or lenders, ensure all parties sign.

Once you have completed the form, review it for accuracy. It is essential to keep a copy for your records and provide a copy to the other party involved in the agreement.

Key takeaways

When filling out and using the South Dakota Promissory Note form, consider the following key takeaways:

- Understand the Purpose: A promissory note is a legal document that outlines a borrower's promise to repay a loan. It is essential for both parties to understand its implications.

- Complete All Required Information: Ensure that you fill in all necessary details, including the names of the borrower and lender, the loan amount, interest rate, and repayment schedule.

- Specify the Interest Rate: Clearly state the interest rate. If it is not specified, the loan may be considered interest-free, which could lead to misunderstandings.

- Include Payment Terms: Detail how and when payments will be made. This includes the frequency of payments and any grace periods.

- Signatures Matter: Both the borrower and lender should sign the document. This signifies agreement to the terms outlined in the note.

- Keep Copies: After signing, each party should retain a copy of the promissory note. This serves as proof of the agreement and can be important for future reference.