Free Quitclaim Deed Template for South Dakota

Similar forms

- Warranty Deed: This document guarantees that the seller has clear title to the property and has the right to sell it. Unlike a quitclaim deed, a warranty deed offers protection to the buyer against any future claims on the property.

- Grant Deed: Similar to a warranty deed, a grant deed transfers ownership and assures that the property has not been sold to anyone else. However, it does not provide the same level of protection as a warranty deed.

- Deed of Trust: This document involves three parties: the borrower, the lender, and a trustee. It secures a loan with the property as collateral, similar to how a quitclaim deed transfers ownership but with financial obligations attached.

- Lease Agreement: A lease agreement allows a tenant to use a property for a specified time in exchange for rent. While it does not transfer ownership, it grants rights to use the property, akin to the rights conveyed in a quitclaim deed.

- Life Estate Deed: This type of deed allows a person to live in a property for the duration of their life. Once they pass away, ownership transfers to another party, similar to how a quitclaim deed transfers ownership without warranties.

- Special Purpose Deed: This deed is used for specific transactions, such as transferring property for tax purposes or in a divorce settlement. It is similar to a quitclaim deed in that it transfers ownership but is often limited to particular situations.

- Rental Application: To facilitate the tenant selection process, utilize the comprehensive Rental Application form requirements for gathering vital applicant information.

- Affidavit of Heirship: This document establishes the heirs of a deceased person and can be used to transfer property without going through probate. Like a quitclaim deed, it facilitates the transfer of ownership without a formal sale.

- Bill of Sale: While primarily used for personal property, a bill of sale transfers ownership from one party to another. It is similar to a quitclaim deed in that it conveys rights but does not guarantee the title’s condition.

Misconceptions

Understanding the South Dakota Quitclaim Deed form is essential for anyone involved in property transactions. However, several misconceptions exist about this legal document. Below are nine common misconceptions and clarifications regarding the Quitclaim Deed in South Dakota.

- Quitclaim Deeds Transfer Ownership Completely: Many believe that a quitclaim deed transfers full ownership of a property. In reality, it only conveys whatever interest the grantor has, which may not be complete or free of claims.

- Quitclaim Deeds Are Only for Family Transfers: Some people think quitclaim deeds are exclusively used for transferring property between family members. They can be used in various situations, including sales, transfers to trusts, or resolving title issues.

- Quitclaim Deeds Are Always Quick and Easy: While quitclaim deeds can be simpler than other types of deeds, they still require proper completion and recording. Mistakes can lead to delays or legal issues.

- Quitclaim Deeds Provide Guarantees: A common misconception is that quitclaim deeds guarantee clear title. They do not provide any warranties or guarantees regarding the property’s title status.

- Quitclaim Deeds Are Only for Real Estate: Some think quitclaim deeds can only be used for real estate transactions. They can also apply to other types of property, such as vehicles or personal property, although this is less common.

- All States Use the Same Quitclaim Deed Form: Many assume that the quitclaim deed form is uniform across all states. Each state has its own requirements and forms, so it is crucial to use the correct one for South Dakota.

- Quitclaim Deeds Eliminate Liens: A misconception exists that quitclaim deeds remove existing liens on a property. They do not affect any existing liens or encumbrances; these remain with the property.

- Quitclaim Deeds Require Notarization: While notarization is often recommended, it is not always a legal requirement for a quitclaim deed to be valid in South Dakota. However, notarization can help with acceptance by third parties.

- Quitclaim Deeds Are Irrevocable: Some believe that once a quitclaim deed is executed, it cannot be revoked. In certain circumstances, it may be possible to challenge or reverse a quitclaim deed, depending on the situation.

Awareness of these misconceptions can lead to better understanding and use of the South Dakota Quitclaim Deed form. Proper knowledge helps in making informed decisions during property transactions.

Fill out Some Other Templates for South Dakota

South Dakota Poa - Enables designated individuals to manage child-related matters legally.

The Indiana Transfer-on-Death Deed form allows property owners to transfer their real estate to beneficiaries upon their death, avoiding the lengthy probate process. This deed provides a simple way to ensure that your property goes directly to your loved ones without the complications of a will. For more detailed information on this subject, you can visit the Transfer-on-Death Deed page. If you're ready to fill out the form, click the button below.

South Dakota Bill of Sale Pdf - Once the bill of sale is signed, it formally marks the end of the seller’s ownership of the trailer.

Title Renewal - In certain states, a notarized Bill of Sale may be necessary for specific transactions.

Guidelines on Utilizing South Dakota Quitclaim Deed

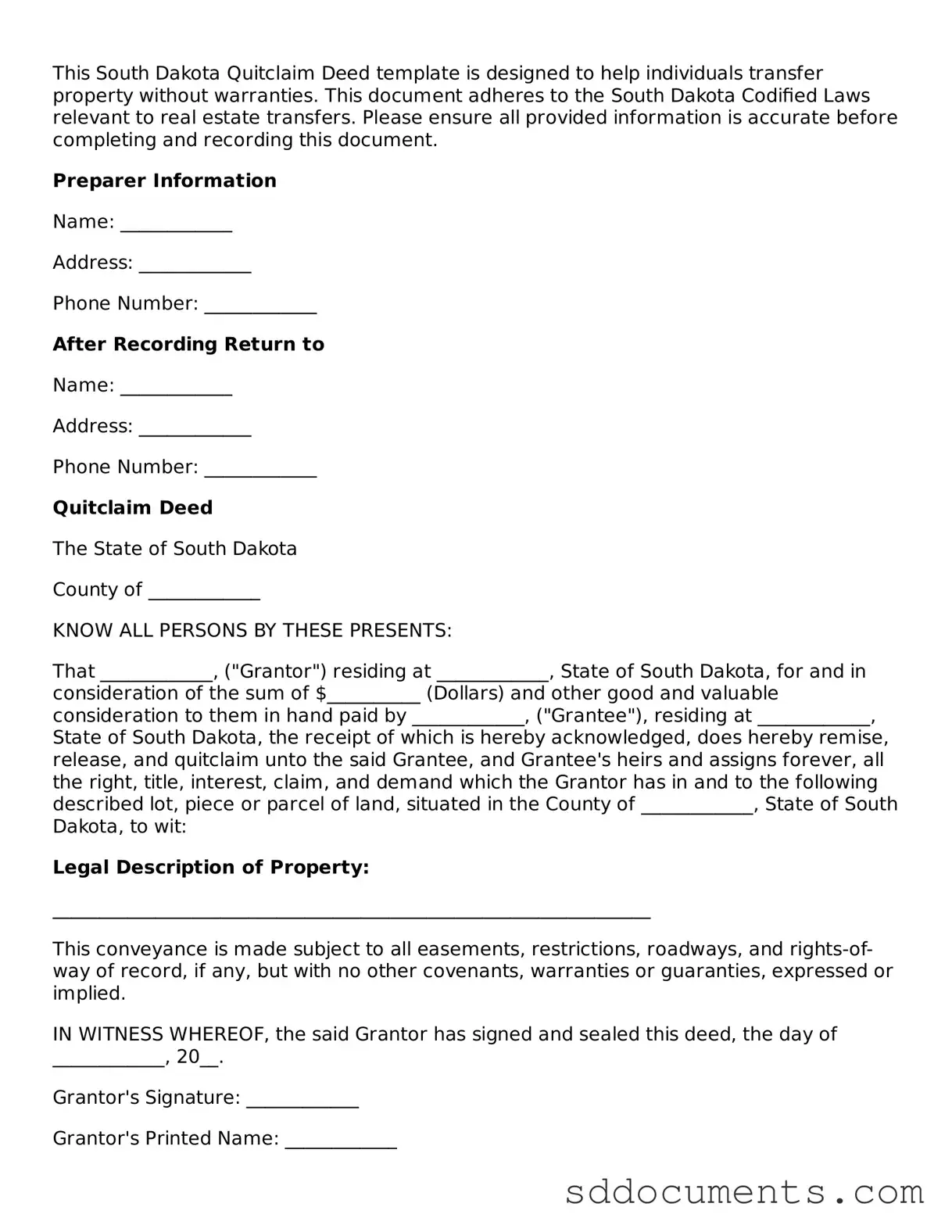

Once you have gathered the necessary information, you can proceed to fill out the South Dakota Quitclaim Deed form. This process is straightforward, but accuracy is essential. Follow these steps to ensure you complete the form correctly.

- Begin by entering the name of the grantor, the person transferring the property. Ensure that the name is spelled correctly and matches official documents.

- Next, provide the name of the grantee, the individual receiving the property. Double-check the spelling and accuracy of this information as well.

- In the designated section, write the address of the grantee. This should include the street address, city, state, and zip code.

- Clearly describe the property being transferred. Include details such as the legal description, parcel number, and any other relevant identifiers.

- Indicate the date of the transaction. This should be the date when the deed is being executed.

- Both the grantor and grantee must sign the form. Ensure that the signatures are dated and that the grantor's signature is notarized.

- Finally, review the entire document for accuracy. Make any necessary corrections before submitting the form.

After completing the form, it is important to file it with the appropriate county office to ensure the transfer is legally recognized. Keep a copy for your records as well.

Key takeaways

Filling out and using the South Dakota Quitclaim Deed form requires attention to detail and understanding of its purpose. Here are some key takeaways to keep in mind:

- Purpose of the Quitclaim Deed: This form is primarily used to transfer ownership of real property from one party to another without guaranteeing that the title is clear. It is essential for situations like transferring property between family members or clearing up title issues.

- Accurate Information: Ensure all names, addresses, and property descriptions are filled out accurately. Mistakes can lead to legal complications or delays in the transfer process.

- Notarization Requirement: The Quitclaim Deed must be signed in the presence of a notary public. This step is crucial as it verifies the identity of the parties involved and ensures the document is legally binding.

- Recording the Deed: After completing the form, it should be filed with the appropriate county office. Recording the deed protects the new owner's rights and provides public notice of the property transfer.