Free Small Estate Affidavit Template for South Dakota

Similar forms

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person. Like the Small Estate Affidavit, it helps facilitate the transfer of property without going through probate.

- Will: A legal document that outlines how a person's assets should be distributed after their death. Both documents serve to direct the distribution of assets, but a will typically requires probate, while a Small Estate Affidavit can avoid that process.

- Vehicle Bill of Sale: This document formalizes the transfer of ownership of a vehicle and is essential for those engaging in vehicle transactions. For more information, visit vehiclebillofsaleform.com/illinois-motor-vehicle-bill-of-sale-template.

- Probate Petition: This is filed to initiate the probate process for a deceased person's estate. While the Small Estate Affidavit can bypass probate for smaller estates, a probate petition is necessary for larger estates.

- Letters Testamentary: These documents are issued by a court to appoint an executor of an estate. In contrast, a Small Estate Affidavit allows heirs to claim assets directly without formal court appointment.

- Trust Documents: These outline how assets are managed and distributed during and after a person's lifetime. Similar to the Small Estate Affidavit, trusts can simplify asset transfer, but they require more formal establishment and management.

- Transfer on Death Deeds: This allows property to transfer directly to beneficiaries upon the owner’s death. Both documents aim to simplify the transfer process, but a Transfer on Death Deed is specific to real estate.

- Community Property Agreements: These documents establish how property is owned and distributed in a marriage. Like the Small Estate Affidavit, they can facilitate asset transfer, particularly in community property states.

- Life Insurance Beneficiary Designations: These forms specify who will receive the proceeds of a life insurance policy upon death. Both documents ensure that assets are transferred outside of probate, providing a quicker resolution for beneficiaries.

Misconceptions

When it comes to the South Dakota Small Estate Affidavit form, several misconceptions can lead to confusion. Understanding these can help individuals navigate the estate settlement process more effectively.

- Only wealthy individuals can use the Small Estate Affidavit. Many believe that this form is reserved for those with significant assets. In reality, it is designed for estates that fall below a certain value threshold, making it accessible to a wider range of individuals.

- The Small Estate Affidavit can be used for any type of asset. Some people think this form applies to all assets. However, it is typically limited to specific types of property, such as personal belongings and certain financial accounts, excluding real estate in many cases.

- Filing the Small Estate Affidavit is a complicated process. While any legal process can seem daunting, the Small Estate Affidavit is relatively straightforward. The form is designed to simplify the transfer of small estates without the need for a full probate process.

- All heirs must agree to use the Small Estate Affidavit. Many assume that unanimous agreement among heirs is necessary. In fact, as long as the affidavit is filed correctly, it can be used even if not all heirs are in agreement.

- You must hire a lawyer to file the Small Estate Affidavit. While consulting a lawyer can be helpful, it is not a requirement. Individuals can complete and file the affidavit on their own if they feel comfortable doing so.

- The Small Estate Affidavit must be filed in court. Some believe that this form needs to be submitted to a court. In South Dakota, the affidavit is typically presented to financial institutions or other entities holding the deceased's assets, not filed with the court.

- Using the Small Estate Affidavit eliminates all taxes. Many think that filing this affidavit means no taxes are owed. However, estate taxes may still apply depending on the overall value of the estate and the nature of the assets involved.

- The Small Estate Affidavit can be used for estates with outstanding debts. Some people mistakenly think they can use this form even if the deceased had debts. While it can be used for small estates, any debts must still be addressed before assets are distributed.

Fill out Some Other Templates for South Dakota

Sioux Falls Dmv Phone Number - A Motor Vehicle Bill of Sale can help expedite the process of vehicle registration in the new owner's name.

Understanding the significance of an effective Operating Agreement for LLCs is vital for any business owner. This document plays a crucial role in establishing clear operational guidelines and delineating member responsibilities, ultimately fostering better governance within the company.

South Dakota Will Template - Offers an avenue for personal reflections and expressions of love to be shared posthumously.

Guidelines on Utilizing South Dakota Small Estate Affidavit

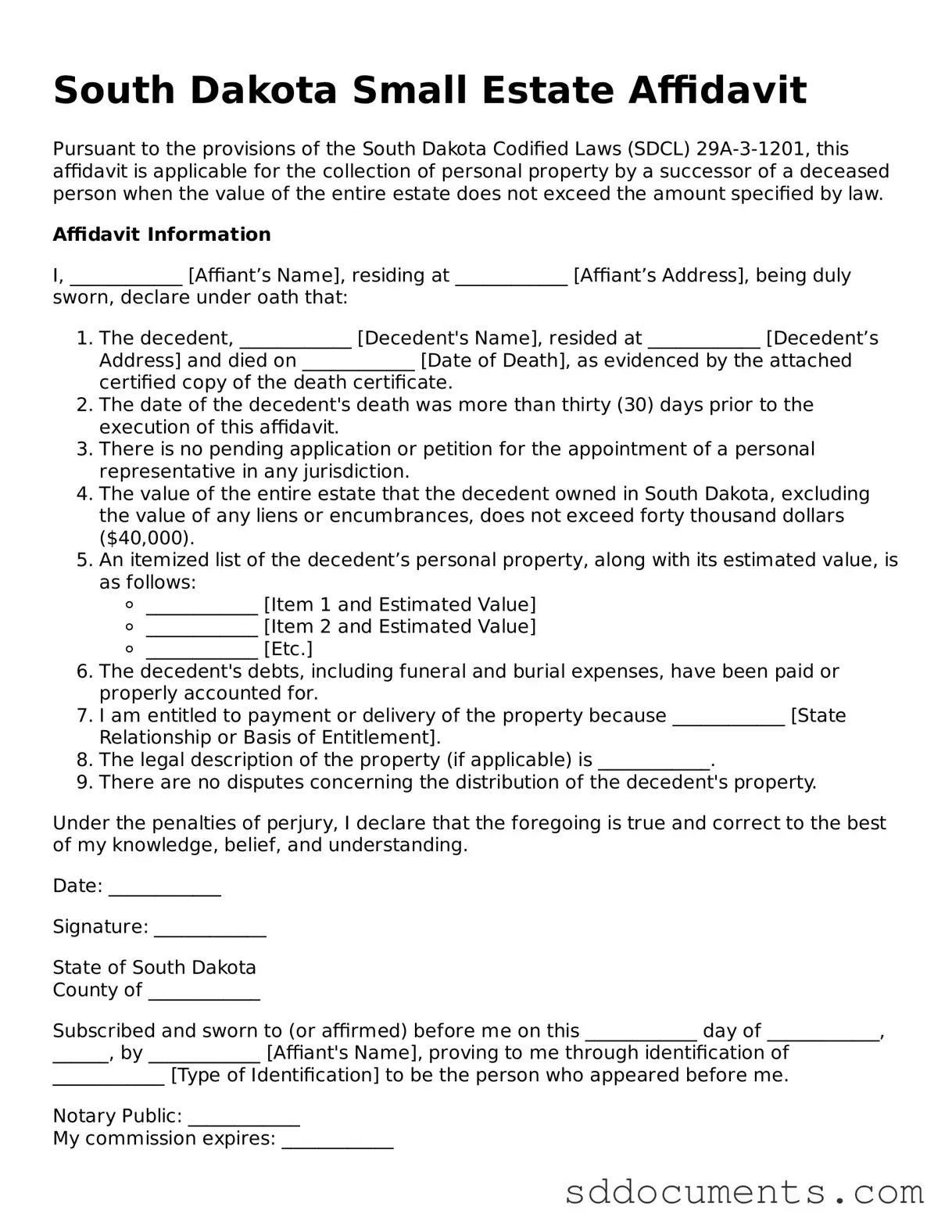

Once you have gathered the necessary information and documentation, you can proceed to fill out the South Dakota Small Estate Affidavit form. This form allows you to claim assets without going through the full probate process, provided certain conditions are met. Follow these steps carefully to ensure that you complete the form correctly.

- Begin by downloading the South Dakota Small Estate Affidavit form from the appropriate state website or obtaining a physical copy from the local courthouse.

- At the top of the form, fill in the decedent's name, date of death, and last known address.

- Provide your name and address as the affiant (the person making the affidavit).

- Include the relationship to the decedent, such as spouse, child, or other relative.

- List the names and addresses of all heirs or beneficiaries entitled to the estate.

- Detail the assets of the estate, including bank accounts, real estate, and personal property. Be specific and include approximate values.

- Indicate whether there are any outstanding debts or claims against the estate.

- Sign and date the affidavit in the designated area, affirming the truthfulness of the information provided.

- Have the affidavit notarized to ensure its validity.

- Make copies of the completed affidavit for your records and for any heirs or beneficiaries.

After completing the form, you will need to file it with the appropriate court, along with any necessary supporting documents. This will initiate the process of transferring the assets to the heirs without the need for a lengthy probate procedure.

Key takeaways

When dealing with the South Dakota Small Estate Affidavit form, it's important to understand the key points to ensure a smooth process. Here are some essential takeaways:

- The Small Estate Affidavit is designed for estates with a total value of less than $50,000, excluding certain assets.

- To use the affidavit, you must be an heir or a person entitled to inherit under South Dakota law.

- The form must be signed under penalty of perjury, which means you are affirming the truthfulness of the information provided.

- You need to provide a list of all assets owned by the deceased, including their estimated values.

- It's crucial to include a statement indicating that no probate proceedings are pending or have been initiated.

- Once completed, the affidavit should be filed with the appropriate county register of deeds office.

- After filing, you can use the affidavit to collect assets from financial institutions or other entities holding the deceased's property.

- Consider consulting with a legal professional to ensure the affidavit is filled out correctly and complies with local laws.

Using the South Dakota Small Estate Affidavit can simplify the process of settling an estate, but careful attention to detail is essential.