Fill Out Your South Dakota 55 Template

Similar forms

The South Dakota 55 form, which is an application for exemption or transfer of liability concerning unemployment insurance, shares similarities with several other documents used in various contexts. Below is a list of six documents that are comparable to the South Dakota 55 form, highlighting their similarities:

- IRS Form 940: This form is used for reporting annual Federal Unemployment Tax Act (FUTA) taxes. Like the South Dakota 55, it addresses unemployment insurance but focuses on federal obligations rather than state-specific exemptions.

- IRS Form 941: This is the Employer's Quarterly Federal Tax Return. Similar to the South Dakota 55, it involves reporting on employment and wages, although it is more about tax obligations rather than exemption applications.

- State Unemployment Insurance (SUI) Application: Each state has its own form for employers to register for unemployment insurance. This document serves a similar purpose as the South Dakota 55 form, as it involves compliance with state unemployment regulations.

- Business License Application: When starting a business, entrepreneurs often need to fill out a business license application. This document, like the South Dakota 55, requires information about the business and its ownership structure, ensuring compliance with local laws.

- Transfer of Ownership Agreement: This document is used when a business is sold or transferred. It shares similarities with the South Dakota 55 form in that it outlines the details of ownership changes and responsibilities, including any liabilities associated with unemployment insurance.

- Transfer-on-Death Deed: Similar to the South Dakota 55 form, this deed allows property owners to transfer their real estate seamlessly; for more information, visit the Transfer-on-Death Deed page to ensure your property goes directly to your beneficiaries without complications.

- Partnership Agreement: When forming a partnership, parties must create an agreement detailing their roles and responsibilities. This is akin to the South Dakota 55 form, as it involves the transfer of responsibilities and liabilities among business owners.

Misconceptions

Misconceptions about the South Dakota 55 form can lead to confusion and potential issues for business owners. Here are seven common misunderstandings, along with clarifications for each:

- 1. The form is only for businesses that are closing. Many believe that the South Dakota 55 form is exclusively for businesses that are shutting down. In reality, it can also be used by businesses that are sold or transferred, allowing for the proper handling of unemployment insurance responsibilities.

- 2. Completing the form guarantees exemption from all liabilities. Some individuals think that submitting this form automatically absolves them from any future liabilities. However, the form only applies to the specific circumstances outlined and does not eliminate all potential responsibilities.

- 3. Only sole proprietors need to file this form. There is a common belief that only sole proprietorships are required to use the South Dakota 55 form. In fact, all types of business entities, including corporations and partnerships, must complete it when applicable.

- 4. The form can be submitted at any time without consequences. Many assume that there is no deadline for submitting the South Dakota 55 form. However, timely submission is crucial, especially if there are changes in ownership or business status that could affect unemployment insurance obligations.

- 5. The form is not necessary if there are no employees. Some business owners think they can skip the form if they have no employees. Yet, if there is any history of employee wages being paid, the form may still be required to properly manage unemployment insurance accounts.

- 6. The form is only for businesses that have been sold. A misconception exists that the South Dakota 55 form is only relevant for businesses undergoing a sale. However, it is also applicable for mergers, dissolutions, and other types of ownership changes.

- 7. The form is a one-time requirement. Many believe that filing the South Dakota 55 form is a one-and-done process. In truth, if circumstances change in the future, such as resuming business operations or transferring ownership again, the form may need to be submitted once more.

Understanding these misconceptions can help business owners navigate their responsibilities more effectively and ensure compliance with South Dakota’s unemployment insurance laws.

Common PDF Documents

Sd Drivers License - The form is designed to streamline the aerial pesticide application licensing process.

To ensure a smooth transfer of ownership, it is important for both buyers and sellers to fill out the necessary paperwork carefully. The Illinois Motor Vehicle Bill of Sale form can be accessed easily for this purpose, making the process straightforward for all parties involved. For more detailed instructions and the form itself, visit https://vehiclebillofsaleform.com/illinois-motor-vehicle-bill-of-sale-template/.

South Dakota Unemployment Employer Registration - The submission of Form 21C can help maintain the integrity of your business practices.

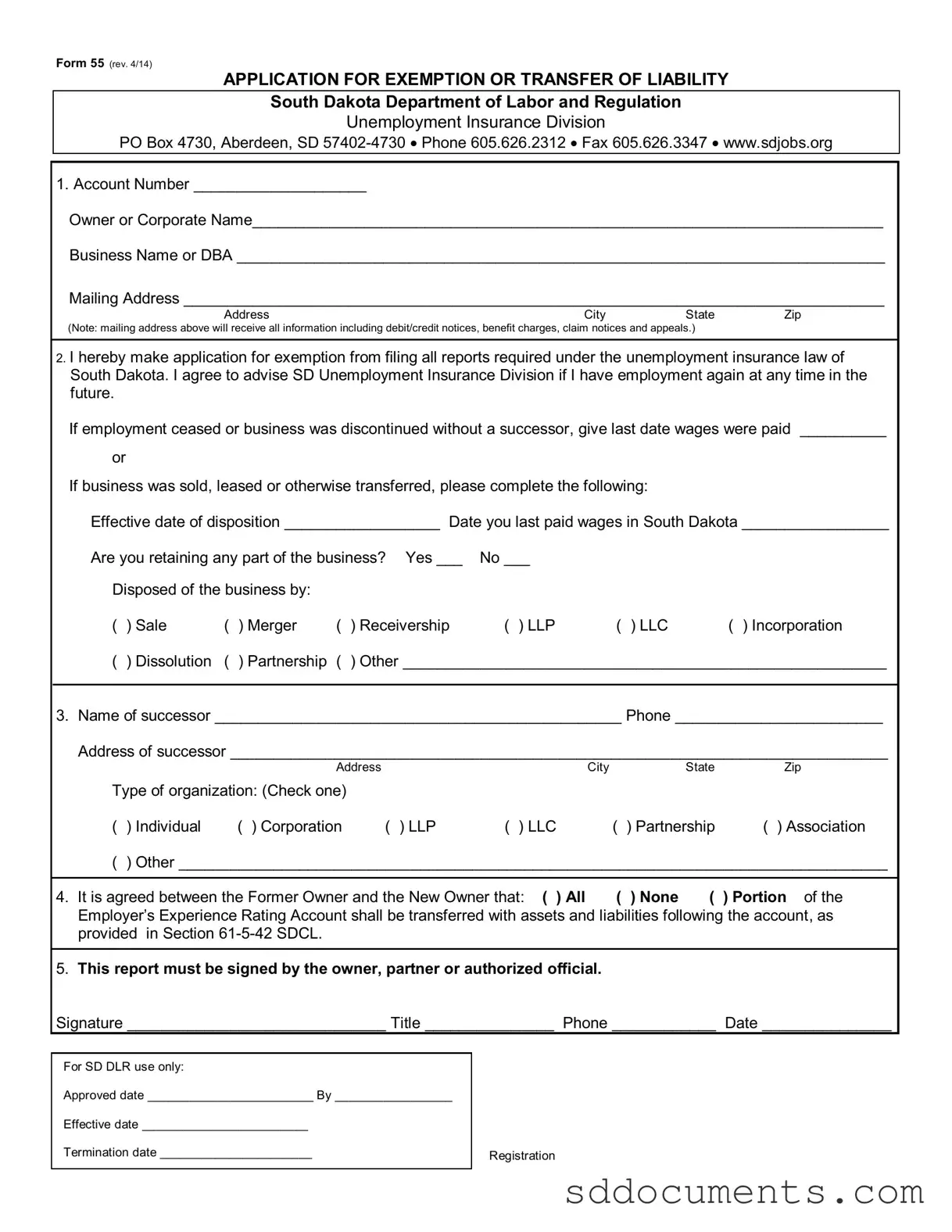

Guidelines on Utilizing South Dakota 55

Completing the South Dakota 55 form is an essential step for those seeking an exemption or transfer of liability regarding unemployment insurance. This form collects important information about your business and its ownership status. Follow these steps carefully to ensure accurate submission.

- Account Number: Write your account number at the top of the form.

- Owner or Corporate Name: Fill in the name of the owner or the corporate entity.

- Business Name or DBA: Enter the name of your business or "Doing Business As" name.

- Mailing Address: Provide your complete mailing address, including city, state, and zip code. Remember, this address will receive all relevant notices.

- Application for Exemption: Indicate your request for exemption from filing reports. Acknowledge that you will inform the South Dakota Unemployment Insurance Division if you have employment in the future.

- Last Date Wages Paid: If applicable, note the last date wages were paid if your business ceased operations.

- Effective Date of Disposition: Fill in the date when the business was sold, leased, or transferred.

- Date Last Paid Wages: Provide the date you last paid wages in South Dakota.

- Retaining Part of the Business: Indicate whether you are retaining any part of the business by checking "Yes" or "No."

- Disposed of the Business: Check the appropriate box to indicate how the business was disposed of (e.g., Sale, Merger, etc.).

- Name of Successor: Enter the name of the new owner or successor.

- Phone of Successor: Provide a contact number for the successor.

- Address of Successor: Fill in the successor's complete address, including city, state, and zip code.

- Type of Organization: Check the box that describes the type of organization of the successor.

- Experience Rating Account: Agree on whether all, none, or a portion of the Employer’s Experience Rating Account will be transferred.

- Signature: The form must be signed by the owner, partner, or an authorized official. Include their title, phone number, and the date of signing.

Once you have completed the form, review it for accuracy before submitting it to the South Dakota Department of Labor and Regulation. Ensure that all required fields are filled out correctly to avoid delays in processing your application.

Key takeaways

Here are key takeaways regarding the South Dakota 55 form, which is used for applying for exemption or transfer of liability under the state's unemployment insurance law.

- Purpose of the Form: The South Dakota 55 form is primarily for businesses seeking exemption from filing unemployment insurance reports or for transferring liability when a business is sold or otherwise disposed of.

- Accurate Information: Ensure all information, including the account number, business name, and addresses, is accurate. This will prevent delays in processing your application.

- Notification Requirement: If you are granted an exemption, you must notify the South Dakota Unemployment Insurance Division if you resume employment in the future.

- Successor Details: If the business is transferred, provide complete information about the successor, including their name, phone number, and address. This is crucial for the transfer of the employer’s experience rating account.

- Signature Requirement: The form must be signed by the owner, partner, or an authorized official. Make sure to include the title and date of signing to validate the application.