Fill Out Your South Dakota From 21C Template

Similar forms

The South Dakota Form 21C is designed to correct information previously submitted regarding unemployment insurance. Several other documents serve similar purposes in various contexts. Below is a list of these documents and their similarities to Form 21C.

- IRS Form 941-X: This form allows employers to correct errors on previously filed Form 941, which reports income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Like Form 21C, it addresses inaccuracies in reported wages and tax liabilities.

- Non-disclosure Agreement (NDA): This document is essential for protecting sensitive information shared between parties, similar to how other correction forms ensure compliance and accuracy. For templates, visit https://nytemplates.com.

- State Unemployment Insurance Correction Form: Many states have their own forms for correcting unemployment insurance reports. These forms, similar to Form 21C, enable employers to amend wage and tax information to ensure compliance with state regulations.

- W-2c Form: The W-2c is used to correct errors on previously issued W-2 forms. It provides a mechanism for employers to rectify mistakes in employee wage reporting, akin to the purpose of Form 21C.

- Form 1099-MISC Correction: When errors occur on Form 1099-MISC, which reports payments made to independent contractors, a correction form is necessary. This process parallels that of Form 21C in addressing reporting inaccuracies.

- Employer’s Quarterly Federal Tax Return (Form 941): While not specifically a correction form, if an employer discovers an error after filing, they may need to adjust future filings. This process is similar to the adjustments made with Form 21C.

- Form 7200: This form is used to request an advance payment of the employer credits due under the CARES Act. If an employer discovers a miscalculation, they may need to amend previous submissions, similar to the corrections made with Form 21C.

- State Tax Correction Form: Various states provide forms to correct errors in state income tax withholdings. These forms serve a purpose similar to Form 21C by allowing for the correction of previously submitted tax information.

Each of these documents plays a crucial role in ensuring accurate reporting and compliance with tax and labor regulations, reflecting the importance of rectifying errors in official submissions.

Misconceptions

Many people have misunderstandings about the South Dakota Form 21C, which is used to correct previously submitted information. Here are four common misconceptions:

- It can only be used for one specific error. Some believe that the form is limited to correcting a single mistake. In reality, you can address multiple errors on the same form, as long as you provide clear explanations for each correction.

- Only large companies need to file this form. This is not true. Any employer, regardless of size, may need to submit Form 21C if they discover discrepancies in their unemployment insurance reports. It is important for all employers to ensure their records are accurate.

- Submitting the form means you will automatically incur penalties. Many fear that correcting a mistake will lead to penalties. While there may be penalties for late filings or significant errors, simply submitting Form 21C does not automatically result in additional fees. It shows a proactive approach to compliance.

- Filing the form is a complicated process. Some people think that completing Form 21C is overly complex. In fact, the form is straightforward and user-friendly. Clear instructions are provided, making it accessible for anyone to fill out correctly.

Understanding these misconceptions can help you navigate the correction process with confidence. If you have questions, don't hesitate to reach out to the South Dakota Department of Labor and Regulation for assistance.

Common PDF Documents

South Dakota Unemployment Employer Registration - Documentation of ownership changes is necessary for proper administrative action.

The Indiana Transfer-on-Death Deed form allows property owners to transfer their real estate to beneficiaries upon their death, avoiding the lengthy probate process. This deed provides a simple way to ensure that your property goes directly to your loved ones without the complications of a will. For more information on how to complete this process effectively, consider reviewing the Transfer-on-Death Deed.

Guidelines on Utilizing South Dakota From 21C

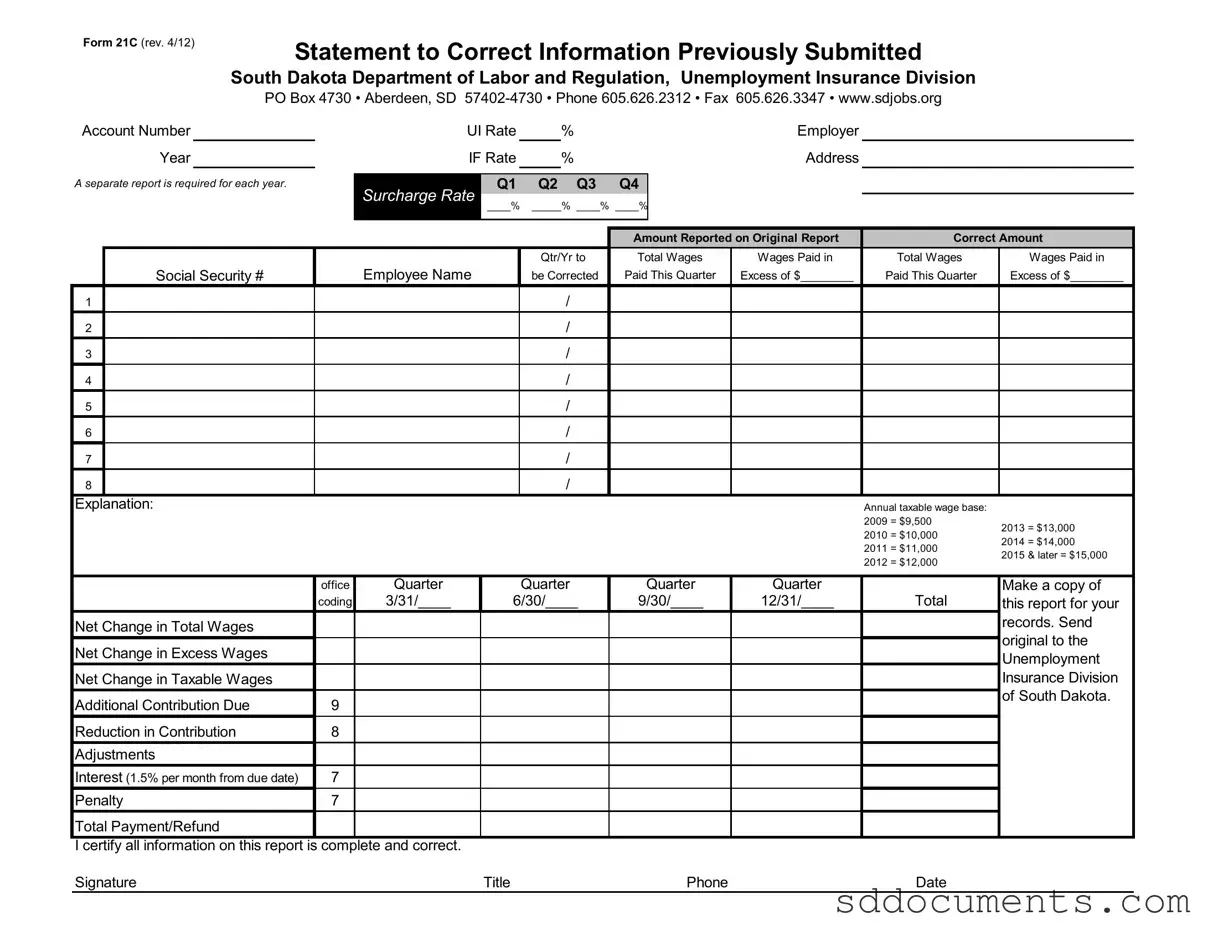

Completing the South Dakota Form 21C is an important step in correcting any previously submitted information regarding unemployment insurance. This form allows employers to ensure their records are accurate and up to date. Follow the steps below to fill out the form correctly.

- Begin by entering your Account Number in the designated field at the top of the form.

- Fill in the Employer Year for which you are making corrections.

- Indicate the UI Rate % and IF Rate % as applicable.

- Provide your Address in the specified area.

- For each quarter, enter the Surcharge Rate for Q1, Q2, Q3, and Q4.

- In the section for Amount Reported on Original Report, fill in the total wages that were originally reported.

- Next, enter the Correct Amount for the total wages in the corresponding field.

- List the Wages Paid in This Quarter for each employee and indicate any excess amounts.

- Provide an Explanation for the corrections being made.

- Ensure you include the Total Wages and Wages Paid in Social Security for each employee listed.

- Calculate the Net Change in Total Wages and any Excess Wages that need to be reported.

- Fill in the Additional Contribution Due and any Adjustments that apply.

- Calculate any Interest and Penalty amounts, if applicable.

- Finally, sum up all amounts to determine the Total Payment/Refund due.

- Sign the form, providing your Title, Phone number, and the Date of submission.

Once you have completed the form, make a copy for your records. Send the original to the South Dakota Department of Labor and Regulation, Unemployment Insurance Division, at the address provided on the form.

Key takeaways

Filling out and using the South Dakota Form 21C requires attention to detail and adherence to specific guidelines. Here are five key takeaways regarding this form:

- Purpose of the Form: Form 21C is designed to correct information previously submitted to the South Dakota Department of Labor and Regulation regarding unemployment insurance.

- Separate Reports: Employers must submit a separate Form 21C for each year that requires corrections. This ensures clarity and accuracy in reporting.

- Accurate Reporting: It is crucial to provide both the amount reported on the original report and the correct amount. This helps to reconcile any discrepancies in wage reporting.

- Quarterly Breakdown: The form requires a breakdown of wages by quarter. Employers must specify the wages paid in each quarter and identify any excess amounts.

- Certification: Employers must certify that all information provided on the form is complete and correct. This certification includes a signature, title, phone number, and date, which adds a layer of accountability.