Free Transfer-on-Death Deed Template for South Dakota

Similar forms

Will: A will outlines how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, it allows for the transfer of property, but a will goes into effect only after probate, while a Transfer-on-Death Deed allows for immediate transfer upon death without the need for probate.

Living Trust: A living trust is a legal entity that holds assets during a person's lifetime and specifies how they should be distributed after death. Similar to a Transfer-on-Death Deed, it helps avoid probate, but it requires more formal management and can involve more complex documentation.

Beneficiary Designation: Commonly used for retirement accounts and life insurance policies, a beneficiary designation allows individuals to name who will receive their assets upon their death. This is similar to a Transfer-on-Death Deed in that it ensures direct transfer of assets without probate.

Joint Tenancy with Right of Survivorship: This arrangement allows two or more people to own property together. When one owner passes away, their share automatically transfers to the surviving owner(s). Like a Transfer-on-Death Deed, it facilitates the transfer of property without going through probate.

Payable-on-Death (POD) Accounts: A POD account allows individuals to name a beneficiary who will receive the account's funds upon their death. This is akin to a Transfer-on-Death Deed, as both enable a straightforward transfer of assets without the complications of probate.

Rental Application: To streamline the tenant selection process, landlords often utilize the comprehensive rental application form to gather necessary information from prospective renters.

Life Estate Deed: This type of deed allows a person to retain the right to live in a property while designating a beneficiary to receive it after their death. While it provides a similar outcome to a Transfer-on-Death Deed, it also involves more complex ownership rights during the grantor's lifetime.

Misconceptions

Understanding the South Dakota Transfer-on-Death (TOD) Deed can be crucial for estate planning. However, several misconceptions surround this legal tool. Here are seven common misunderstandings:

- 1. A TOD Deed is the same as a will. Many people think a TOD Deed functions like a will, but it is not. A will goes into effect only after death, whereas a TOD Deed allows for the immediate transfer of property upon the owner's death without going through probate.

- 2. The property is automatically transferred before death. Some believe that the property is transferred to the beneficiary while the owner is still alive. This is incorrect. The property remains with the owner until their passing, at which point the transfer occurs automatically.

- 3. A TOD Deed can only be used for residential property. This is a common myth. In South Dakota, a TOD Deed can be used for various types of real estate, including commercial properties and vacant land.

- 4. You cannot change the beneficiary after the deed is created. Many think that once a TOD Deed is established, it cannot be altered. In reality, the owner can revoke or modify the deed at any time before their death.

- 5. A TOD Deed avoids all taxes. While a TOD Deed can help avoid probate, it does not exempt the property from estate taxes. Beneficiaries may still be responsible for any applicable taxes upon inheritance.

- 6. Only individuals can be beneficiaries. Some individuals assume that only people can be designated as beneficiaries. However, entities like trusts or organizations can also be named as beneficiaries in a TOD Deed.

- 7. A TOD Deed eliminates the need for a comprehensive estate plan. Many believe that having a TOD Deed is sufficient for estate planning. While it is a useful tool, it should be part of a broader estate plan that considers all assets and potential issues.

By dispelling these misconceptions, individuals can make more informed decisions about their estate planning needs in South Dakota.

Fill out Some Other Templates for South Dakota

Uncontested Divorce in South Dakota - This settlement can help mitigate the emotional impact of divorce.

The Indiana Transfer-on-Death Deed form allows property owners to transfer their real estate to beneficiaries upon their death, avoiding the lengthy probate process. This deed provides a simple way to ensure that your property goes directly to your loved ones without the complications of a will. For more information on this process, you can refer to the Transfer-on-Death Deed source, and if you're ready to fill out the form, click the button below.

Blank Promissory Note - Changes to the original note may require mutual agreement from both parties.

Guidelines on Utilizing South Dakota Transfer-on-Death Deed

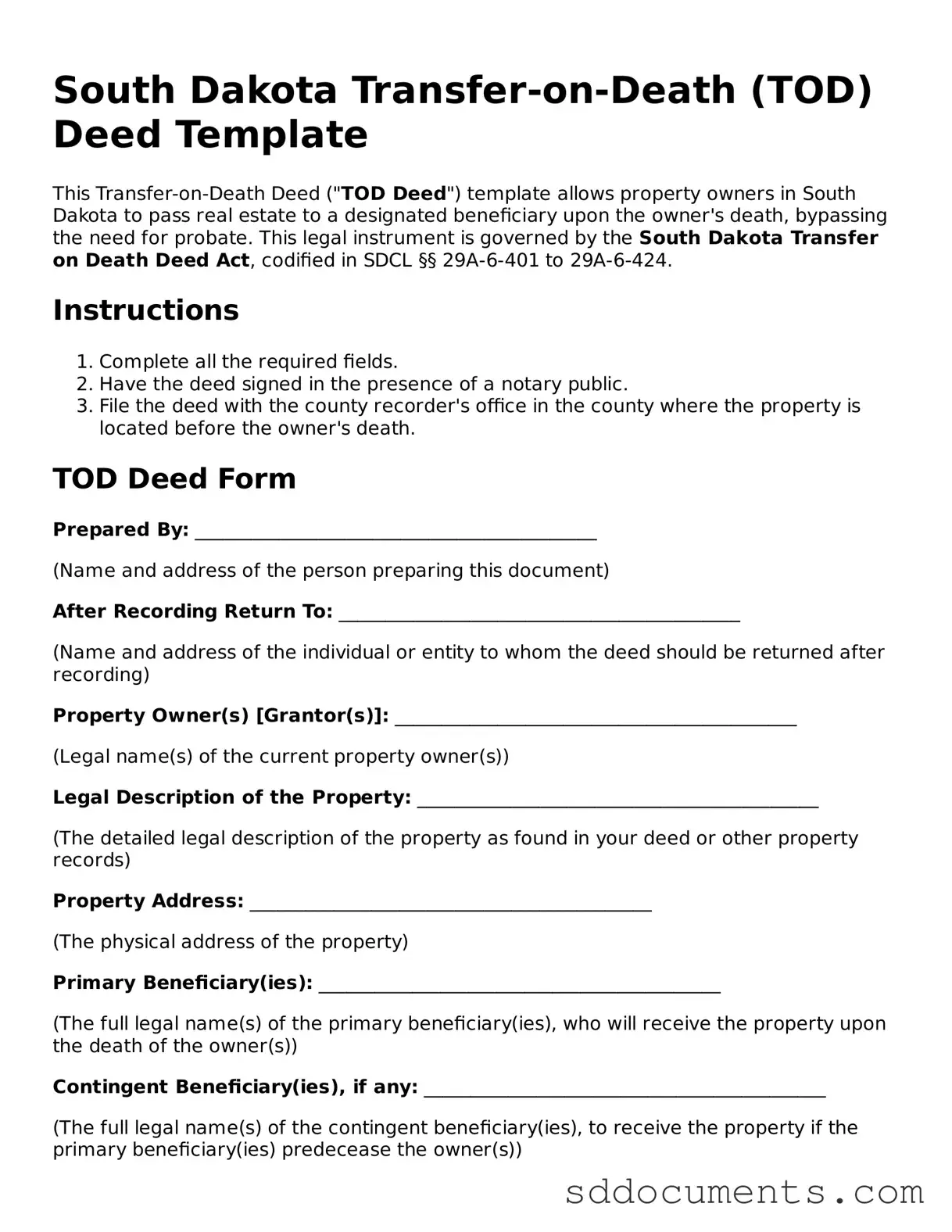

After obtaining the South Dakota Transfer-on-Death Deed form, it is important to complete it accurately to ensure the transfer of property upon death is executed as intended. Follow these steps carefully to fill out the form correctly.

- Obtain the Form: Download the South Dakota Transfer-on-Death Deed form from the official state website or acquire a physical copy from a local office.

- Identify the Property: Clearly describe the property that is being transferred. Include the legal description, address, and any other identifying details.

- Provide Grantor Information: Fill in the name and address of the person transferring the property (the grantor). Ensure this information is accurate.

- List Beneficiaries: Enter the names and addresses of the individuals or entities who will receive the property upon the grantor’s death. Be specific and accurate.

- Include Additional Instructions: If there are any specific instructions or conditions regarding the transfer, include them in this section.

- Sign the Form: The grantor must sign the form in the presence of a notary public. This step is crucial for the form to be legally binding.

- Notarization: Have the notary public complete their section, confirming that the grantor signed the document in their presence.

- Record the Deed: Submit the completed and notarized form to the appropriate county register of deeds office. This step ensures the deed is officially recorded.

Key takeaways

When it comes to using the South Dakota Transfer-on-Death Deed form, there are several important points to keep in mind. This form allows property owners to designate beneficiaries who will receive their property upon their death, without the need for probate. Here are some key takeaways:

- Understand the Purpose: The Transfer-on-Death Deed is specifically designed to transfer real estate directly to beneficiaries, simplifying the process for your heirs.

- Eligibility: Any individual who owns real property in South Dakota can use this deed to designate beneficiaries.

- Filling Out the Form: Ensure that all required fields are completed accurately. This includes the property description and the names of the beneficiaries.

- Signatures Required: The deed must be signed by the property owner in front of a notary public to be valid.

- Recording the Deed: After signing, the deed must be recorded with the county register of deeds where the property is located. This step is crucial for the transfer to take effect.

- Revocation: You can revoke or change the beneficiaries at any time before your death by filing a new deed or a revocation form.

- Tax Implications: Be aware that while the Transfer-on-Death Deed avoids probate, it does not avoid estate taxes. Consult a tax advisor for details.

- Beneficiary Rights: Beneficiaries do not have rights to the property until the owner passes away. Until then, the owner retains full control.

- Consultation Recommended: It’s wise to seek legal advice to ensure that your intentions are clearly stated and that the form is filled out correctly.

By keeping these points in mind, you can effectively utilize the South Dakota Transfer-on-Death Deed to ensure your property is passed on according to your wishes.